Residential Window Film Tax Credit

If you’re considering solar control or safety solar control window film for your home, you may be eligible for a tax credit up to 30% of the cost of the improvement, to an annual maximum tax credit of $1,200 as part of the Inflation Reduction Act of 2022 (IRA).

Unlike tax deductions from taxable income, tax credits are a dollar-for-dollar credit or tax deduction. For complete details, please visit https://www.irs.gov/inflation-reduction-act-of-2022

Determine Residential Product Eligibility

- Certified products are sorted by zone then window configuration.

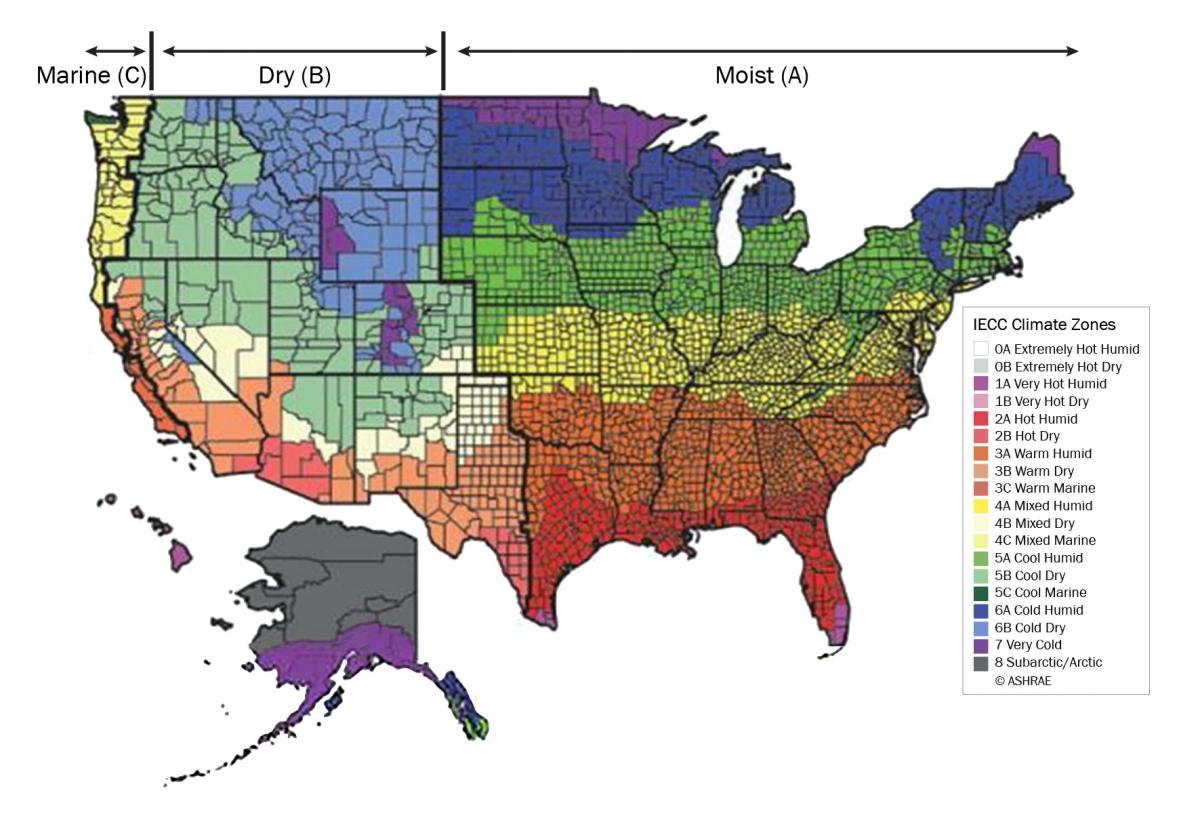

- Refer to the map displayed below and determine your climate zone.

- For each window determine the glazing construction (glass and frame type) of the residence.

- Qualifying products designated with a “YES” and frame type (V- Vinyl, W-Wood or M-Metal) that are found to comply for that climate zone and window configuration.

- Retain copies of both dealer invoice and the Solar Gard certification statement for your records.

Climate Zone Links:

VIEW QUALIFYING PRODUCTS FOR:

Additional Notes:

- For storm windows use the double pane clear or double pane tinted configuration for determining product compliance.

- Compliance is not dependent on other factors, such as, trees, bushes, adjacent buildings, internal or external shaded devices (screens, blinds, or curtains) nor is the orientation of the windows with the residence.

- If unable to determine the exact glass type use the more conservative value. If you do not know if a window is clear or low-e use the clear. If you know the glazing has a low-e coating but do not know the type use the winter low-e column.

- Use of the Solar Gard solar safety versions is allowed as long as the standard film is also a qualifying product.

- The use of Solar Gard window film products on the following tables does not imply any warranty. Please consult your Solar Gard dealer for complete warranty information.

Applying for Your Residential Tax Credit:

- Complete IRS form 5695 and file with the following year Income Tax Returns. Forms are downloadable at irs.gov along with a list of other available energy efficiency tax credits.

- You will need to have a copy of the dealer invoice listing the cost of the film separate from the installation labor and a copy of the Solar Gard Certification Statement to include with your records.